The gold sector catches fire around the world, as share prices soar and cash rolls in

Since the nadir of late March, the gold price has added more than US$500 an ounce, a rise of around 33%, which makes it one of the best performing asset classes of the year.

It seems that the old and oft-repeated adage of the gold bulls, that gold is a safe-haven in a crisis, has once again been borne out, and that as cash and other assets decline in relative and real value, gold is once again the place to be.

And gold now within touching distance of US$2,000, those companies that mine and explore for it are enjoying a stellar run on the markets.

Whats been really remarkable is the value that has been created at the top end, which runs into the billions of dollars. Thus, for example, Barrick Gold is now worth over US$50bn, whereas in June it was worth a little less than US$45bn, and in late March, not much more than US$30bn. These are huge numbers for a gold sector had that looked like it was in for a period of long-term stagnation after the end of the third round of quantitative easing in the middle part of the last decade.

There had already been some movement before the coronavirus crisis, as markets fretted about US-China relations an anaemic growth. But the coronavirus really set the price moving, as governments the world over began an unprecedented new round of money printing. Petropavlovsk, Pure Gold

Theres more than one way to play a market, though. Holders of physical gold are sitting on pretty gains of more than 33%, that is, if one is still using the US dollar as a benchmark currency.

But holders of mid-tier companies like Centamin PLC (LON:CEY), Evolution Mining (ASX:EVN), or Pure Gold Mining (CVE:PGM)(LON:PUR) are sitting on much larger gains. In the case of Centamin and Pure the share price rise booked over the past 12 months has been over 100%, while Evolution isnt far off.

Australian boom set the stage

And its actually in Evolutions home stomping ground of Australia that the action initially got underway. Because although the gold price may be hitting record levels in US dollar terms right now, in Aussie dollar terms, its been doing so for some time. And that in turn has led to an ebullience in the Australian gold scene that the rest of the world is only just beginning to catch up to.

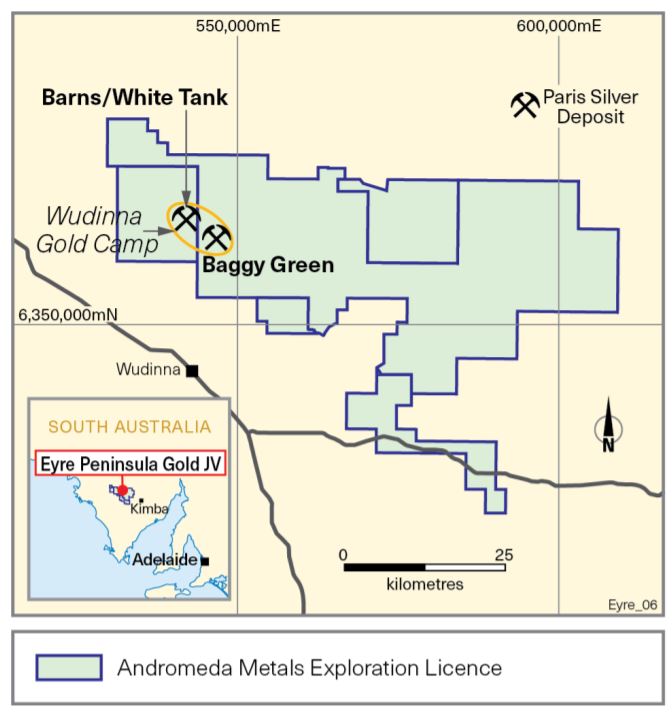

In part, this has been helped along by the recent successes of Kirkland Lake Gold (TSE:KL)(ASX:KLA) at the Fosterville mine in Victoria. But its also been buoyed by exploration successes scored by the likes of Greatland Gold (LON:GGP) and Newcrest (ASX:NCM) in the Paterson region and elsewhere in Western Australia. Activity in both states is humming along, and the corporate manoeuvring has been underway for some time.

One of the more recent examples is Shandong Golds battle with Nordgold for control of Cardinal Resources (ASX:CDV), with Shandong at this stage currently holding the upper hand. But watch this space – both for more on the fate of Cardinal, which has now recommended shareholders accept the Shandong offer, and for new signs of corporate activity bubbling up.

Possible contenders for involvement could be Kirkland Lake itself, although its still busy digesting its recent acquisition of Detour, St Barbara Mines (ASX:SBM), also digesting an acquisition, and Pantoro (ASX:PNR), which owns the ancient and renowned Central Norseman project.

Then theres Bellevue Gold (ASX:BGL), Red 5 (ASX:RED), Musgrave Minerals (ASX:MGV) and Bardoc Gold (ASX:BDC).

Meanwhile, larger and larger sums of money are becoming available for expansion and growth. One of the most recent raises comes from Tietto Minerals (ASX:TIE), which is currently in the processing of bringing in A$62.5mln of new money.

Meanwhile, over in Canada…

In the context of the current gold price, the strong share price performances of the mid-tier companies isnt surprising. Companies like Endeavour Mining, (TSE:EDV), Alamos Gold (TSE:AGI), Centerra (TSE:CG), Eldorado (TSE: ELD), B2Gold (TSE:BTO) and New Gold (TSE:NGD>Read More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]