Comet Resources higher on acquiring development-ready gold project in Mexico

Comet Resources Limited (ASX:CRL) is higher after signing a binding heads of agreement for the acquisition of the high-grade Santa Teresa Gold Project in Baja California, Mexico.

This project is in the gold-rich historical mining district of El Alamo and has an existing non-JORC inferred resource of 64,000 ounces at an average grade of 8.7 g/t at a cut-off grade of 4 g/t.

The company is developing a portfolio of base/precious metal projects and the acquisition complements and builds on its recent acquisition of the Barraba Copper Project in NSW, Australia.

$20 million financing[hhmc]

Concurrent with the acquisition, Comet has executed a non-binding term sheet with Raptor Capital International Limited for a gold streaming and royalty financing to fund activities at Santa Teresa for up to US$20 million.

Shares have been as much as 100% higher to 3 cents intra-day and are now trading 40% higher at 2.1 cents.

“Potential to add value” to Comet[hhmc]

Comet managing director Matthew OKane said: “Santa Teresa contains attractive near-surface high-grade gold mineralisation that is open along strike and at depth.

“Along with the non-dilutive development funding from Raptor, I believe subject to completion of due diligence, the project has potential to add significant value to Comet.

“Whilst we work through the detail on Santa Teresa, we continue preparations for the initial field exploration program at Barraba, likely to commence in quarter three.”

Acquisition on a staged basis[hhmc]

A binding heads of agreement (HOA) has been signed with privately-owned El Alamo Resources Limited (EARL) and the acquisition will be completed on a staged basis.

Comet will acquire a 50% interest upon satisfaction of due diligence and the initial US$6 million financing being made available to the company.

The remaining 50% interest will be acquired upon a decision to mine being made in respect of the project.

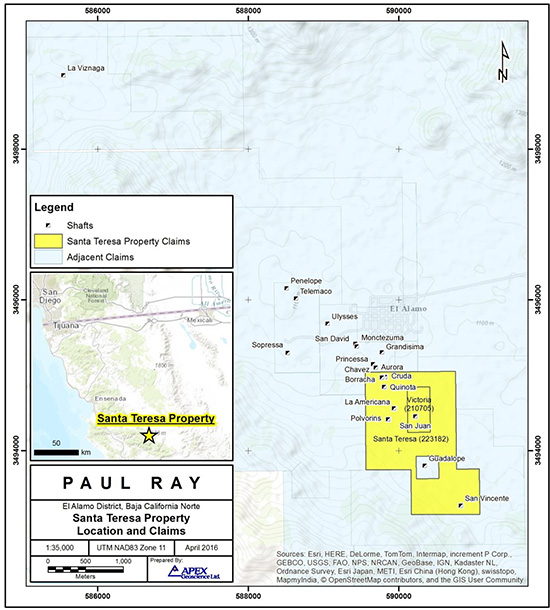

Santa Teresa project location.

Exploration upside[hhmc]

Comet believes there is strong exploration upside and opportunity to expand current mineralisation due to the under-explored nature of the tenements and the gold-rich nature of the district.

This belief is supported by the fact that individual assay grades used in the resource estimate were capped to 20 g/t.

Strong gold fundamentals[hhmc]

The company is also buoyed by gold market fundamentals with the precious metal sitting at around decade highs.

It may have further upside to price due to the current economic uncertainty caused by the COVID-19 pandemic and the related unrelenting money printing of many central banks.

Historical production in the surrounding El Alamo district is estimated at between 100,000 to 200,000 ounces.

There have been 32 diamond holes drilled into the project delivering numerous high-grade intersections, including:

- 2 metres at 32.4 g/t from 19 metres;

- 1-metre at 958.4 g/t from 239 metres;

- 2.5 metres at 38 g/t from 174 metres;

- 3.9 metres at 39 g/t from 121 metres;

- 1-metres at 125.9 g/t from 83 metres; and

- 3.1 metres at 16 g/t from 101 metres.

The project comprises twRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]