White Rock Minerals poised to take rejuvenated company forward with a wider shareholder base after an eventful year

White Rock Minerals Ltd (ASX:WRM) (OTCMKTS:WRMCF) is in excellent shape to take on the 2020/2021 financial year with a considerably wider and more international shareholder base.

The company has a significant JORC 2012 resource base in gold, silver and zinc, which represent a great opportunity for growth and value creation.

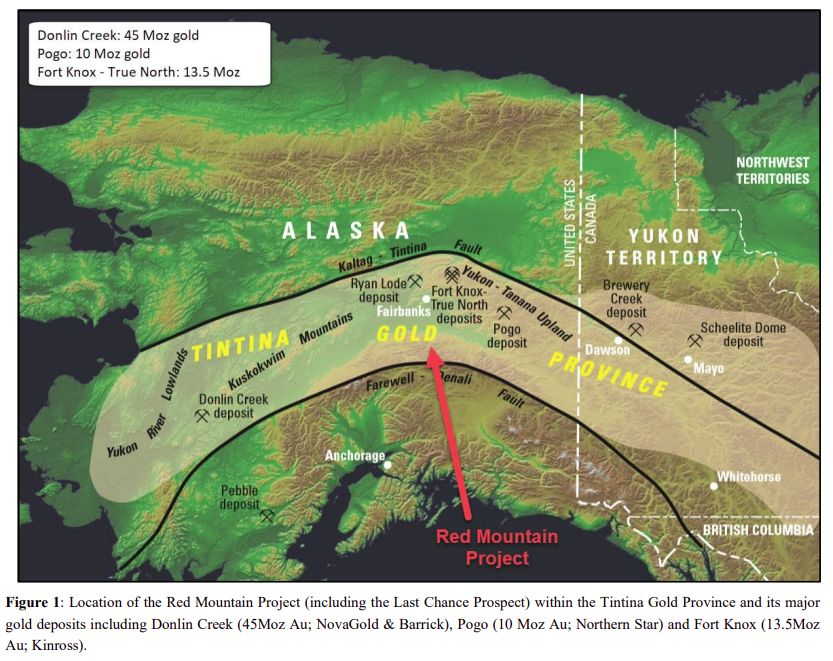

It has some 76 million ounces of silver, 700,000 ounces of gold, 678,000 tons of zinc and 286,000 tons of lead contained in indicated and inferred categories between its Red Mountain Project in Alaska, which includes the Last Chance prospect and Mt Carrington Project in northern New South Wales.

“Promise of more success”[hhmc]

A joint statement from chairman Peter Lester and Matthew Gill said: “We are well funded, have an exciting new gold prospect at Last Chance, have a robust and high-value PFS completed for Mt Carrington and the promise of more success at the Red Mountain VMS.”

“We now have a considerably wider and more international shareholder base from which to take a rejuvenated White Rock Minerals forward.”

White Rock Minerals Ltd (ASX:WRM) (OTCQX:WRMCF) shares are now trading on the US-based OTCQX Best Market, the highest market tier of OTC Markets on which 11,000 US and global securities trade.

Trading on US bourse[hhmc]

White Rock Minerals shares are now trading on the US-based OTCQX Best Market, under the ticker symbol of WRMCF.

The US listing is expected to enhance White Rocks focus on the high-grade zinc-silver-gold-lead VMS and IRGS project at Red Mountain.

It is also an important step in the growth aspirations for the company following the strong interest shown by North American investors in a recent equity raising and trading on the ASX, as well as to raise awareness about the companys high-grade silver-zinc-gold-lead VMS and gold IRGS project.

Red Mountain Project[hhmc]

The Red Mountain drilling season in 2019 was focussed on step-out drilling to find additional mineralised VMS lodes to add to the known West Tundra Flats and Dry Creek Resources.

Although results were technically interesting, no potential new lodes were identified, but further drill targets still remain to be tested.

Importantly, the final drill hole of the 2019 season was drilled beneath the known Dry Creek Resource and had success in identifying potential for a major down-dip and possibly along strike extension.

The beginning of 2020 saw the withdrawal of JV partner, Sandfire Resources, from the Red Mountain JV, although the timing coincided with the identification and announcement of the significant new Last Chance gold prospect discovery west of Red Mountain.

With this gold discovery, White Rock Minerals moved quickly to ensure it maintained its large and strategic land holding of about 798 square kilometres.

“With record gold prices and strong market enthusiasm, our focus has been to pursue the Last Chance gold opportunity and this continued throughout the 2020 field season,” the company said.

The promising VMS work will be taken up again as funding permits.

Mt Carrington[hhmc]

The company raised $15 million by July 2020 on the back of record gold prices, increasingRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]