MMJ Group Holdings set to capitalise on WeedMD investment as company scales up

MMJ Group Holdings Ltd (ASX:MMJ) (OTCMKTS:MMJJF) is focused on adding to its portfolio of investments in the cannabis value chain in Australia, Canada and Europe.

The addition of WeedMD Inc. (CVE:WMD) (OTCMKTS:WDDMF) (FSE:4WE) in September 2019 is proving to be valuable, with the company producing cannabis products for both the medicinal and adult-use markets in Canada across its three branches – StarSeed Medical Inc, Color Cannabis and CX Industries.

WeedMe announced a C$2.5 million capital raising in March 2020 which strengthened its balance sheet to support its growth plans.

StarSeed Medical Inc[hhmc]

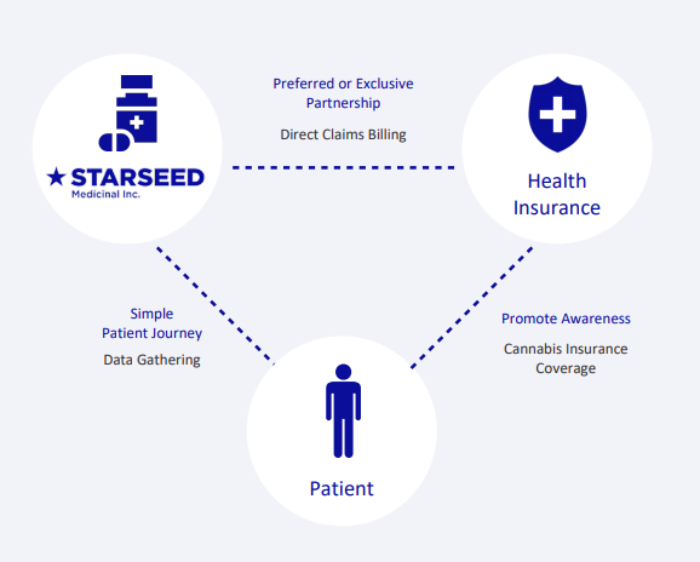

The unique direct-to-consumer medical platform StarSeed Medical is the market leader in insured medical cannabis.

StarSeed focuses on captive patients with benefits plans and insurers to launch customized insured medical cannabis programs to uniquely pair a care service model with medical-grade cannabis.

This targets valuable and overlooked medical channel sales with a closed-loop model which provides exclusive access to around 350,000-plus potential patients, offering patient-centred cannabis as a service.

Color Cannabis[hhmc]

The Color Cannabis brand consists of a range of distinctive products cultivated with care in the adult-use market.

WeedMD is focused on building brand awareness via promotional tools that trigger interaction, drive awareness and inspire trial at retail and online.

With the exclusive launch of renowned strain Black Sugar Rose, the introduction of a vaporization (vape) and pre-roll line, as well as new nitrogen-infused packaging, the company is executing on its commercial growth plans.

The closed loop medical system offers patient-centred cannabis as a service.

MMJs investment[hhmc]

MMJs investment in WeedMD now comprises:

a) C$6 million in 8.5% unsecured convertible debenture units issued by WeedMD which MMJ has the option to convert into 3.75 million shares by September 25, 2022 (the debenture units have preference over ordinary shares with interest paid to MMJ on quarterly basis); and

b) Warrants that allow MMJ to acquire an additional 3.75 million shares for C$1.80 each by September 25, 2022.

The group is well-placed to capitalise on WeedMDs focus on growth of its indoor and outdoor cultivation, combined with in-house extraction, product development and manufacturing capabilities.

WeedMD is optimized to grow at scale with the ability to expand to double the current size with modest incremental capexRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]