Magmatic Resources subsidiary to spin-off and list on ASX after acquiring gold/ polymetallic projects

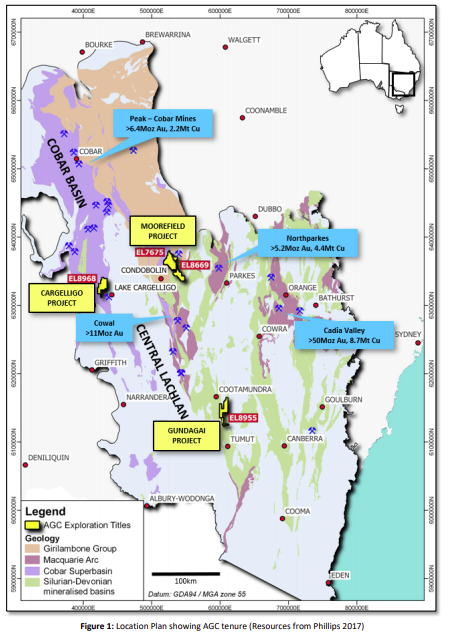

Magmatic Resources Limited (ASX:MAG) said its wholly-owned subsidiary Australia Gold and Copper Ltd (AGC) plans to seek a listing on the ASX after undertaking a series of asset purchases in the highly prospective central Lackland Fold Belt in New South Wales.

The assets AGC is eyeing include Magmatics Moorefield Gold Project and two other highly prospective central Lacklan gold/polymetallic projects – Cargelligo and Gundagai projects – from New South Resources Pty Ltd (NSR).

NSR will receive as consideration AGC shares amounting to a 40% interest in AGC pre the initial public offering (IPO) proposed to be undertaken by AGC. Magmatic will hold the remaining 60% in AGC pre-IPO.

Following the demerger of the Moorefield project, Magmatic will remain focused on its East Lachlan gold and gold-copper porphyry projects.

Junior explorer with a majors portfolio[hhmc]

Magmatic executive chairman David Richardson said: “Combined with the exciting Gundagai and Cargelligo projects, identified and developed by NSR CEO Glen Diemar, AGCs three projects represent a major portfolio with each project significant in their own right.

“We have always described MAG as a junior explorer with a majors portfolio, and this transaction will further unlock shareholder value, giving shareholders exposure to both MAG and AGC shares and further upside of two new gold projects.

“We are excited that Glen Diemar will join as AGC managing director, bringing his extensive knowledge of the Central Lachlan region, project development experience and exploration success."

NSR CEO Glen Diemar added: “The potential of each of these three assets to host significant, near surface resources is exciting and within Australian Gold and Copper the future of these assets is clearly on a strong trajectory for unlocking that value.

“We are excited to bring together an advanced portfolio of targets, each with outcropping mineralisation and historic or recent drilling intercepts.”

AGC IPO[hhmc]

Magmatic shareholders will see immediate increased shareholder value as they will own shares in both Magmatic and AGC via the proposed in-specie share distribution.

Details of the priority entitlement to AGC IPO will be provided in due course.

The demerger of Moorefield and the NSR acquisitions remain contingent on Magmatic shareholder approval, satisfactory tax ruling from the Australian Taxation Office on the distribution in specie, regulatory approvals, compliance with ASX escrow requirements and waivers, among others.

Proposed AGC board[hhmc]

The board of AGC will initially comprise of:

➢Managing director Diemar who has extensive experience in all sectors of the mining and exploration industry, with a focus on NSW mineral systems and early-stage discoveries. Diemar has worked at BHP Billiton and numerous juniors, both internationally and locally;

➢Non-executive director Richardson who is Magmatic executive chairman;

➢An independent non-executive chairman; and

➢Under the binding term sheet, Magmatic has the right to appoint another director.

[hhmc]

The combined AGC portfolio offers multiple drill-ready targets of Fosterville-style gold, McPhillamys-style gold and Cobar-style gold-polymetallic mineralisation within the Central Lachlan Fold Belt.

Gold and copper 'hotspots'[hhmc]

The Lachlan Fold Belt is one of the worlds gold and copper “hotspots” with a long history of high-grade gold production.

Magmatic recognised the regions potential early and acquired four exploration projects, including Moorefield, from the worlds seventh-largest gold miner, Gold Fields and it believes it has a multi-year head start in the region.

The Moorefield project (EL7675 – Moorefield and EL8669 – Derriwong) comprises two granted exploratioRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]