Alkane Resources focused on growing gold bounty through exploration and strategic investments

Alkane Resources Limited (ASX:ALK) is focused on growing its gold bounty through increasing production at Tomingley Gold Operations (TGO), pursuing organic growth through targeted exploration and development, and strategic investment.

The reliable, existing production from Tomingley met FY20 guidance with 33,507 ounces of gold produced and the company has estimated FY21 guidance at 45-50,000 ounces at an AISC of A$1,450 to A$1,600 per ounce.

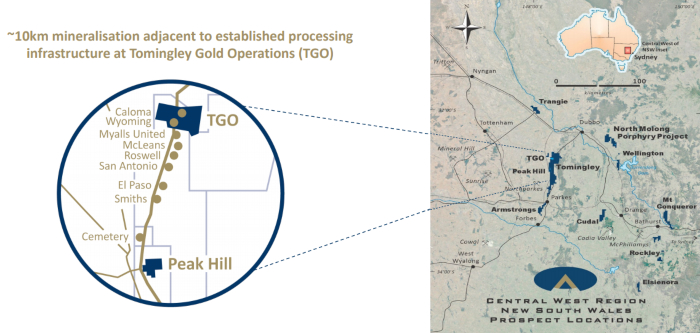

The focus is now on production growth through the Tomingley Corridor via exploration at the San Antonio, Roswell ad El Paso targets and further exploration at the recent Boda discovery.

Tomingley Extension Project[hhmc]

Exploration at Tomingley Gold Operations (TGO) to date includes the completion of infill drilling at 40-metre spacing at the Roswell and San Antonio targets with a further 20-metre program underway.

An exploration drive is planned from the existing Wyoming One decline at TGO with drilling positions and bulk samples between Wyoming and Roswell.

The maiden resource at Roswell is 7.02 million tonnes at 1.97 g/t gold for 445,000 ounces and as the underground extension is the priority for the company with the indicated resource update expected in late quarter three/early quarter four of 2020.

The maiden resource at San Antonio is 7.92 million tonnes at 1.78 g/t gold for 453,000 ounces and the exploration target at El Paso is around 5.1 to 7.4 million tonnes at a grade range of 1.3 to 1.6 g/t.

These three targets bring the total resource for TGO and the Tomingley extension project to 25.4 million tonnes at 1.9 g/t gold for 1.616 million ounces.

Boda discovery[hhmc]

The company has encountered significant gold-copper mineralisation in RC drilling at the Boda discovery to the northeast, which has similar characteristics to Newcrest Mining Limiteds (ASX:NCM) Cadia Valley Mine 110 kilometres to the south.

There are strong indications of a large system at Boda, including intercepts of:

- 689 metres at 0.46 g/t gold and 0.19% copper; and

- 1,167 metres at 0.55 g/t gold and 0.25% copper.

A further 30,000 metre drill program is in progress over FY21, targeting the high-grade core plus prospective areas in the corridor.

Other regional targets presented by IP and data review will also be tested.

Strategic demerger[hhmc]

As of June 30, 2020, the company had $98.4 million in cash, bullion and listed investments.

Additionally, significant value was created through the demerger of Australian Strategic Materials (ASX:ASM) on July 29, 2020.

Pre-demerger, Alkane closed at $1.18, post demerger the share price has traded in a range of $1.04 to $1.31.

Alkane believes the demerged entity closing at $1.40 on the first day, implies a $167 million market cap and ASM trading at $2.19 at close on September 17, 2020, represents $0.44 in Alkane terms.

A major drill program of 30,000 metres is currently underway at Boda

Gold investments support growth[hhmc]

Alkanes vision is to become a multi-mine Australian gold producer, anchored by its Tomingley Gold Operations and strong regional NSW exploration portfolio.

The long-Read More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]