Auroch Minerals leveraged to nickel super-cycle of growing export volumes and recovering prices

Auroch Minerals Ltd (ASX:AOU) is leveraged to the expected nickel super-cycle with Australias nickel export earnings forecast to strengthen on the back of growing export volumes and recovering prices.

In its latest annual report to shareholders, the company states the sector's value is expected to reach $6.8 billion in 2021-2022, up from an estimated $4.3 billion in 2019-2020.

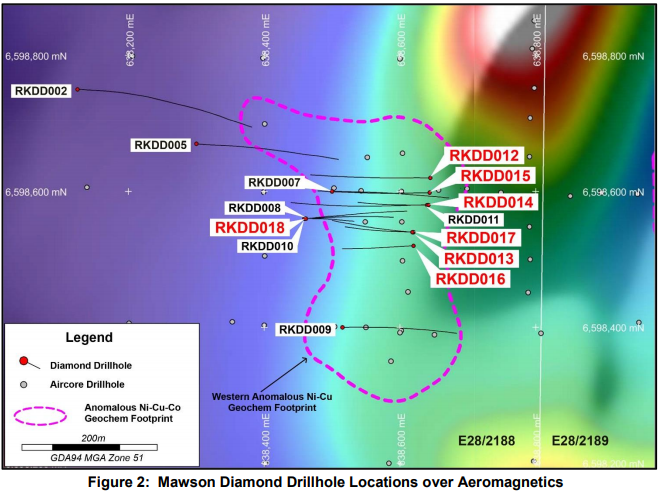

Auroch has a clear strategy to explore its channel targets across both the Saints and Leinster projects while growing its nickel-bearing landholding across Western Australia.

Acquisition of Saints and Leinster in 2019 was perfectly timed, as nickel enjoyed a remarkable resurgence, buoyed by a combination of supply pressures, local high-profile acquisitions and discoveries, tier-1 production restarts and global stainless-steel and lithium-ion battery demand.

The company plans to explore and drill as many of its developing pipeline of high-quality nickel targets as possible to materially increase the existing high-grade massive sulphide resource of 1.05 million tonnes at 2.0% nickel for 21,400 tonnes of contained nickel.

New strategy reaps results[hhmc]

Following having boosted its geological team with the appointment of geologist Robin Cox, non-executive chairman Edward Mason and consultant Peter Muccilli, the companys new strategy bore immediate results with an updated geological model for the Saints project and significant aircore (AC) drilling programs generating a stream of new basal channel targets.

During the period between July 2019-July 2020 Auroch completed three drilling programs acrosRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]