Alkane Resources delivers profit after tax of $12.8 million; aims to expand gold production in NSW

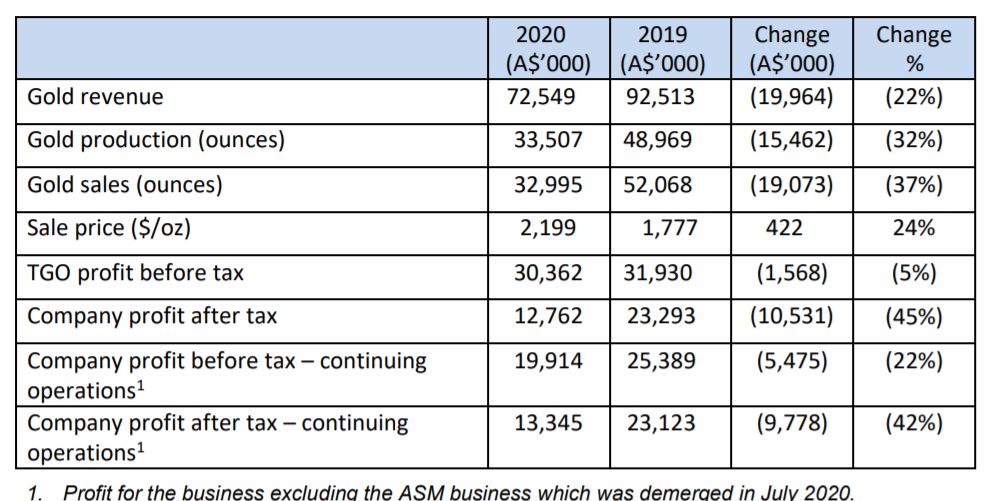

Alkane Resources Limited (ASX:ALK) (OTCMKTS:ALKEF) has delivered a profit after tax of $12.8 million for the financial year ended 30 June 2020 (FY2020).

The profit was largely driven by excellent production and cost performance at the Tomingley Gold Operation (TGO) in NSW where full year guidance was met with 33,507 ounces of gold produced at an all-in sustaining cost (AISC) of A$1,357 per ounce.

The company recently de-merged its Dubbo Project into a separate entity, Australian Strategic Materials Limited (ASX:ASM), which listed on the ASX last month.

Following the demerger, Alkane is now an Australian focused gold company, with existing production from TGO and the opportunity to grow its production base through organic exploration and discovery (including the Boda discovery) and through further strategic acquisitions.

The TGO continues to perform well and is processing underground stope material with recovery as expected.

Gold recovery of 88.1% for in FY2020 was in line with the expectations of processing lower grade stockpiles (FY2019: 91.7%).

Average grade milled declined to 1.45 g/t gold in the current year as a result of processing both medium and low-grade stockpiles as the operation transitions from open cut to underground.

Production for the period was 33,507 ounces of gold (FY2019: 48,969 ounces of gold) with the average sales price achieved for the period increasing to A$2,199 per ounce (FY2019: A$1,777 per ounce).

Next steps at TGO[hhmc]

Alkane has commRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]