Gold-silver ratio reaches highest level in 87 years from lowest level in 41 years

As technical indicators go, the ratio of gold price to silver prices, commonly referred to as the gold-silver ratio, is considered by precious metal traders to be one of the most reliable indicators for forward price movements in silver.

The gold-silver ratio indicates how many ounces of silver are required to buy one ounce of gold. In times where the ratio is relatively high, it acts as a leading indicator for a rise in silvers value.

Previously the highest the ratio has ever been was 132 to 1 in 1933 when the US government invoked Executive Order 6102 and forced US citizens to sell all but a small portion of their gold and silver holdings to the Federal Reserve.

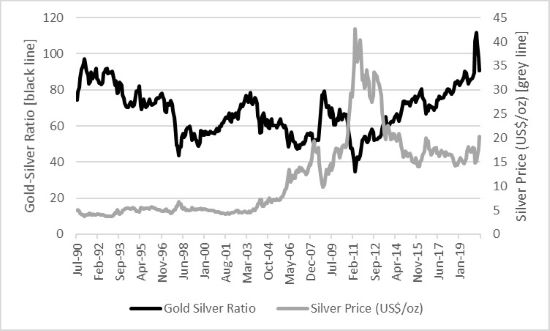

More recently the highest the ratio has reached is 97.3 to 1 in February 1991 (Figure 1), at the height of a global economic recession.

After this high in the ratio, the silver price rose in a continued uptrend from an average price US$3.74/ounce in February 1991 to US$6.84/ounce in February 1998, an increase of 83%.

Figure 1: Gold-Silver Ratio since 1990. Source: Mining and Metals Research Corporation Ltd.

In June 2003, after a sustained five-year period of lower gold-silver ratios, the gold-silver ratio reached a high of 78.7:1, over the next five years the silver price rose from US$4.53 to a high of US$19.32/ounce in March 2008, (Figure 1) an increase of 326%.

A spike in the gold-silver ratio in December 2008 to 79.3:1, associated with another global recession, was a leading indicator of a 315% increase in the silver price from US$10.29/ounce in December 2008 to US$42.7 in April 2011 (Figure 1).

The gold-silver ratio has now risen from a low of 34.7:1 in April 2011, its lowest level since 1979, to its highest level in 87 years of 111.7:1 in April 2020, before reducing to 90.6:1 in July on the back of a 35% rise in the silver price over just three months (Figure 1).

Could we now be facing a sustained uptrend in the silver price?

Historical precedent appears to suggests so, only once in history was silver more undervalued compared to gold than it was in April 2020 and that was in 1933, when the US Government forced its citizens to sell their precious metal holdings.

A rise in the silver price from its current level of US$28.1, would bode well for companies such as:

Silvercorp Metals Inc (NSYEAMERICAN:SVM) (TSE:SVM) is one of very few silver-focused miners and has profitable operations in China. It reported cash flow operations of US$77.2 million in FY20 at an average silver price of US$13.56/ounce.

Silver Mines Ltd (ASX:SVL) hosts the largest undeveloped silver project in Australia and one of the largest globally. Bowdens Silver Project in Central West NSW has a JORC measured, indicated and inferred resource of 128 million tonnes at 40 g/t silver, 0.38% zinc and 0.26% lead for 275 million ounces silver equivalent. The company looks set to add to this bounty from the nearby Barobolar project with sampling returning up to 252 g/t silver.

Argent Minerals Ltd (ASX:ARD) has a suite of projects along the prolific Lachlan Fold Belt in NSW with its flagship Kempfield project hosting a silver-equivalent resource of 52 million ounces with strong potential to add further resources. This project, which is south of the Cadia operations of Newcrest Mining, is a registered NSW State Significant Development.

Red River Resources Limited (ASX:RVR) is diversifying from base metals production in northern Queensland into gold through the Hillgrove project in NSW and is also highly encouraged by high-grade silver of up to 1,730 g/t in initial exploration at the newly acquired Orient project in north Queensland, adjacent to the new Isabel project which has an historic silver resource.

PNX Metals Ltd (ASX:PNX) has the Hayes Creek Zinc and Precious Metals Project in the Northern Territory which includes a silver resource of 9.28 million ounces. With the company focusing on the nearby Fountain Head Gold Project, it has signed a term sheet with private company Halifax Capital and its subsidiary Bridge Creek Mining covering these projects.

Aftermath Silver Ltd (CVE:AAG) (OTCMKTS:AAGFF), which reRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]