Mako Gold pushes forward with drilling program at Napié Project after positive results in June quarter

Mako Gold Ltd (ASX:MKG) has enjoyed a productive June quarter undertaking exploration at its flagship Napié Project in Côte dIvoire.

The company began a 10,000 metre, 90-hole reversed circulation and diamond drill program on the project and to date have received assays for the first five holes.

The majority of the drilling will occur at the Tchaga Prospect located along a 23 kilometre long +40 parts per billion gold soil/auger (yellow/green) anomaly coincident with a +30 kilometre-long shear zone – thought to be a major control for gold mineralisation.

The Tchaga Prospect is only one of four prospects identified from drilling by Mako to date.

The companys short-term goal is to outline a JORC-compliant resource on Tchaga and and continue drilling on the other prospects with the aim of adding to a potential resource.

Tchaga drill results[hhmc]

Drill intersections received from the first five holes of the program include:

- 14 metres at 5.46 g/t from surface, including 5 metres at 11.28 g/t from surface (NARC124);

- 3 metres at 2.35 g/t from 17 metres (NARC124);

- 7 metres at 1.45 g/t from 56 metres (NARC124);

- 9 metres at 4.08 g/t from 80 metres, including 2 metres at 9.47 g/t from 83 metres (NARC124), and;

- 8 metres at 1.59 g/t from 93 metres.

Hole NARC121 returned 5 metres at 1.06 g/t from 7 metres, and 4 metres at 1.33 g/t from 69 metres.

The drilling program will continue through to December 2020.

$3.25 million capital raising[hhmc]

The company recently competed an oversubscribed, two tranch placement to raise $3.25 million.

The placement comprised the issue of 65 million new fully paid ordinary shares in Mako at an issue price of 5 cents per share.

Tranche one of the placement (completed during the quarter), comprised of about 11.3 million new shares (for around $0.60 million), was not subject to shareholder approval and fell within the companys placement capacity under ASX Listing Rule 7.1 and 7.1A.

Tranche two of the placement (completed subsequent to the end of the quarter), comprised 53.7 million new shares (for around $2.68 million), was issued following receipt of shareholder approval at a General Meeting held on 7 July 2020.

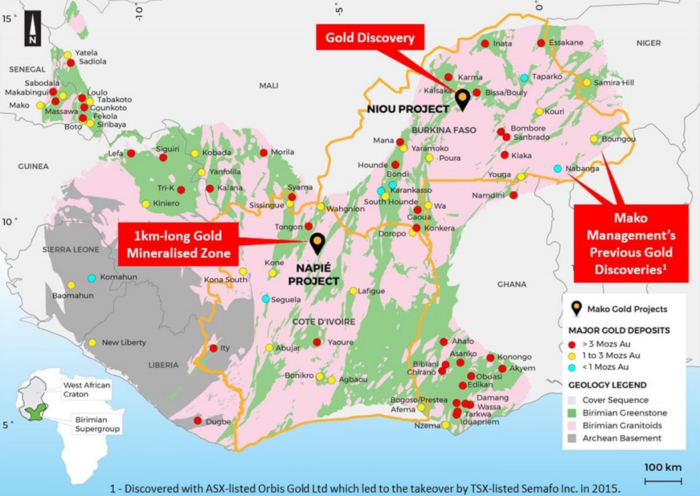

Mako's project locations

Sale of Niou project[hhmc]

During the quarter Mako signed a binding term sheet and a definitive sale agreement to sell its Niou Project in Burkina Faso to Nordgold SE.

Nordgold is an international gold miner which produces 1 million ounces of gold per year from 10 mines (5 in Russia, 3 in Burkina Faso and one each in Guinea and Kazakhstan) and has an operating mine within 50km of the Niou Project – making them an ideal operator forRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]