engage:BDR sets sights on scaling revenue and profitability for 2020

Engage:BDR Ltd (ASX:EN1) is reaping the benefits from several new revenue streams introduced in the first quarter of 2020 and has subsequentially updated its strategic plan for the year.

In a letter to shareholders, co-founder and executive chairman Ted Dhanik said: “The company extends material revenue growth to the first half of 2020 with the strongest first half in EN1 history at about 44% over first half 2019 – regardless of the COVID-19 disruption.

“As the second half begins (peak season), management expects revenue to continue to increase throughout the balance of the year.”

The companys strategic goal for the remainder of the year is to continue to scale revenues and profitability.

Integrations to drive revenue[hhmc]

To date, the company has onboarded more than 230 integrations in the first half of 2020 and is confident the additional ad inventory and advertiser demand will create a network effect where demand on all inventory increases competition for each impression, bid-prices, sell-through and margins all increase; yielding a direct impact on gross profit, net income and EBITDA.

Dhanik said: “engage:BDR is the core business and largest revenue driver.

“[Its] like a stock exchange for digital ad space, which connects thousands of publishers to buyers and all of their transactions are automated, almost exactly like online stock trading platforms.”

The company cites eMarketers forecast that the global directly addressable market size for programmatic advertising in 2021 is expected to reach US$147 billion as the reasoning behind its push in the second half of the year to include new integrations on the platform each quarter.

engage:BDR intends to exceed its target of 238 programmatic integrations by the end of 2020 and is well on-track for this.

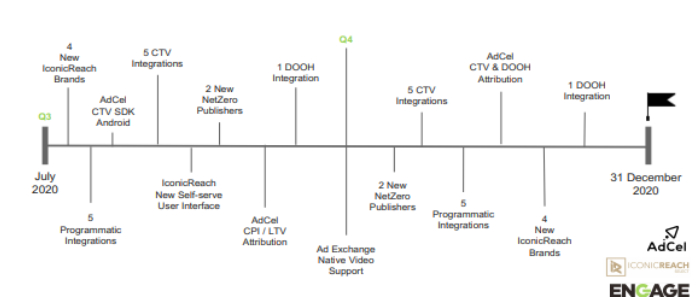

The company's strategic milestones for the second half of the year

New ad inventory quality initiatives[hhmc]

Two new ad inventory quality initiatives (app ads.txt & sellers.json) are now live and generating $5,000 incremental daily revenue on average.

In quarter one, the company successfully listed greater than 50% app ads.txt inventory quality coverage – essentially allowing app publishers list their authorised sellers within a file accessible by anyone, (but typically only buyers), at the time they submit their bid.

The progressive ad inventory quality sellers.json was also launched during the quarter and enables buyers to understand how direct the ad inventory they are buying truly is.

engage:BDR anticipates positive revenue impact in 2020, and in the future, a material difference in sustainability and reduction of competition and growth of margins, as the middlemen would be eventually eradicated by the design of sellers.json.

NetZero targets met[hhmc]

All NetZero targets for the first half have been met with the addition of two new, large publishers per quarter.

NetZero is a post-paid publisher payments solution which significantly improves the cashflow of publishers by providing cost-free, immediate payment of invoices the day EN1 is invoiced.

In contrast, many publishers pay 25% interest on average, per year, for similar access to capital (factoring).

EN1 executes campaigns, sells the ad inventory and invoices the buyers before paying the publishers and is insured for all A/R credit with Euler Hermes credit insurance.

AdCel top performer[hhmc]

AdCel remains a top performer for the company, with a new revenue stream deployed in quarter two.

Native advertising support, within the AdCel DSP, is time-based guaranteed attention product for advertisers, which takes optimisation several steps further by guaranteeing specific time metrics around the viewability of the ad to each user, down to the impression.

Dhanik said “AdCels technology is specifically focused around helping mobile app publishers generate revenue with their traffic, by providing premium advertisers and campaigns.”

During quarter two, AdCel also deployed another new ad format for publishers and AdCel DSP customers in chatbot ads.

The company's three business streams.

IconicReach influencer marketplace[hhmc]

A new potential new revenue stream for the company is IconicReach, which Dhanik said aimed to be the GoogRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]