Latin Resources rises on securing major Argentinian investment company as new partner in “transformational” deal

Latin Resources Ltd (ASX:LRS) (FRA:XL5) has taken a key step on the path to becoming a major lithium industry player by signing a “transformational” joint venture agreement with leading Argentinian investment group Integra Capital SA.

This agreement covers the companys lithium pegmatite projects and will see Integra spend up to US$1 million (A$1.4 million) in a JV to explore, develop and earn 50% of the projects in Argentinas Catamarca province.

In addition, Integra also has an option to become Latins largest corporate shareholder through an equity investment to take a cornerstone 10% holding.

LRS shares surged 166% in early trade to 0.8 cents and closed at 0.6 cents, double the previous close.

Attracted by portfolio[hhmc]

The new partner was attracted to Latins highly prospective and large-scale lithium tenement portfolio in Argentina, as well the companys renowned 10-year operational experience in Latin America.

Integra Capital founder and president Jose Luis Manzano said: “We are very happy in becoming partners with Latin Resources in Argentina to advance this promising lithium pegmatite project.

“We expect to benefit from the knowledge of Latin Resources and contribute with our experience in Argentina and our highly qualified team to advance the project.”

Founded in 1995, Integra has a diversified portfolio in more than 10 countries and has developed projects and ventures with private institutions and investors valued at more than $16.5 billion.

As one of Argentinas largest lithium explorers, Integra holds more than 400,000 hectares of lithium brines projects in Jujuy and Catamarca provinces.

The firm has also developed a portfolio of assets in oil exploration and production, natural gas distribution, electricity generation and distribution, and also has investments in uranium and copper.

Integra provides services such as mergers and acquisitions, financial structuring, IPOs, due diligence procedures, debt and company restructuring.

“An excellent outcome”[hhmc]

In describing the agreement as transformational and an excellent outcome for Latin, managing director Chris Gale said it placed the company in a position to become a significant lithium player to create strong shareholder value.

“We welcome Integra as our partner at our highly-prospective Argentinian lithium pegmatite projects and look forward to delivering significant shareholder value with our new partner.

“Integras financial capacity combined with our track record and experience in Latin America makes a formidable team with the ability to rapidly explore and develop a lithium project.”

Underpins strategic approach[hhmc]

This agreement underpins the strategic approach by Latin in identifying, acquiring and advancing large-scale land positions of highly prospective mineral projects to attract joint venture partners.

Latin has now made progress in commercialising its large South American battery metals assets.

The Peruvian copper projects are being funded by a $10 billion copper company First Quantum Minerals Limited (TSE:FM) (OTCMKTS:FQVLF) and its lithium projects by a billion-dollar company in Argentina.

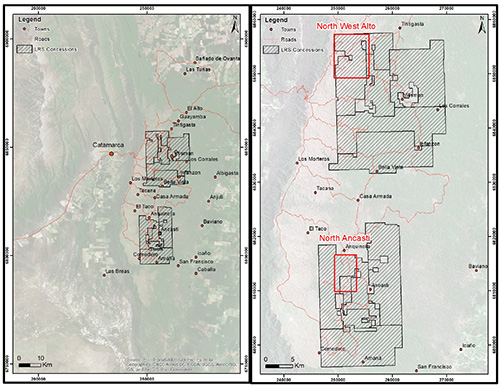

The signing of the binding JV agreement comes after an extensive and thorough negotiations on Latins concessions which encompasses over 70,000 hectares in the province of Catamarca in Argentina.

Integras agreement with Latin signals the investment companys move into the hard rock lithium sector to become a major player in the lithium sector.

The Ancasti and Villisman concessions in the province of Catamarca.

Aggressive exploration program[hhmc]

The new partner will spend up to US$1 million under a JV which will underpin an aggressive exploration program on the Catamarca concessions, with the initial aim of delivering a maiden JORead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]