Perseus Mining Exore acquisition will provide near-mine gold ounces

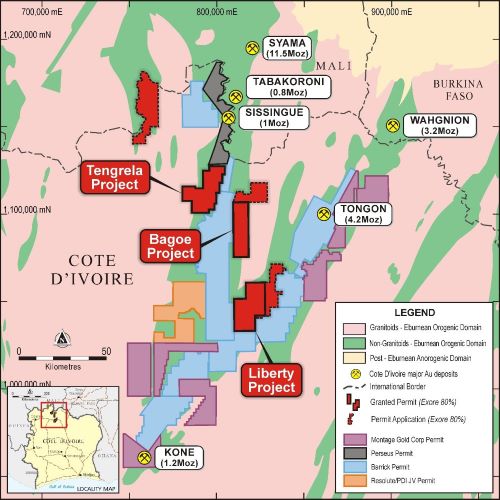

Perseus Mining Limited (ASX:PRU) (TSE:PRU) (OTCMKTS:PMNXF) is acquiring Exore Resources Ltd (ASX:ERX) (OTCMKTS:NLIOF) which will result in Perseus gaining a gold project near its Sissingué Gold Mine in Côte dIvoire.

The parties have entered into a Scheme Implementation Deed which will see Perseus acquire 100% of Exore and the agreement provides a fully diluted equity value of A$59.8 million based on PRUs 10 trading day VWAP.

Resources near Sissingué[hhmc]

Exore will exercise its pre-emptive right to acquire the remaining 20% of the Bagoe and Liberty projects from Apollo Consolidated Limiteds in northern Côte dIvoire for US$4.5 million to obtain 100% ownership.

Bagoe has a maiden JORC-compliant indicated gold resource of 90,000 ounces with a further 440,000 ounces in the inferred category and is within trucking distance of the Sissingué Gold Mine.

“Creating value for shareholders”[hhmc]

Perseus managing director and CEO Jeff Quartermaine said: “The acquisition of Exore results in Perseus gaining ownership of approximately 2,000 square kilometres of geologically prospective land in northern Côte dIvoire, close to our operating Sissingué Gold Mine.

“Sissingué has a mine life of three years from July 1, 2020, and with the acquisition of Exores land package, including defined mineral resources, we have the option of developing Bagoe into a new mine potentially using the Sissingué infrastructure, or alternatively, delineating further mineral resources that can be economically mined and trucked to our Sissingué plant for processing.

“Either option provides an opportunity to continue creating value for Perseuss shareholders.”

Exore recommendation[hhmc]

Exores board unanimously recommends that Exore shareholders vote in favour of the scheme, in the absence of a superior proposal and subject to an independent experts report concluding that the scheme is in the best interests of shareholders.

Acquisition of the remaining interest in the projects will be funded by Exore from its existing cash.

Scheme consideration[hhmc]

The scheme consideration of A$59.8 million is calculated on a fully diluted basis applying a purchase price of A9.8 cents per share and this is based on Perseuss 10 trading day VWAP.

Consideration will be paid in the form of shares in Perseus with each Exore shareholder receiving 1 Perseus share for every 12.79 Exore shares held.

This share swap ratio is based on the 10-day VWAP of Perseus shares on June 2, 2020, and implies a price of A10.5 cents per Exore share based on Perseuss closing share price on that date.

This consideration represents a premium of:

- • 69% to Exores closing share price of A$0.062 on June 2, 2020; and

- • 78% to the 20-trading day VWAP of Exore of A$0.059, up to and including June 2, 2020.

Highly prospective ground[hhmc]

Exore holds around 2,000 square kilometres of highly prospective land in northern Côte dIvoire, near the Sissingué mine.

An 80% joint venture in exploration permits making up the Bagoe and Liberty projects, which cover 816 square kilometres, was acquired from Apollo in December 2018.

Exore then expanded this position through additional earn-in and joint venture agreements with local Ivorian groups.

This area is relatively under-explored but known to host geological structures on which several significant gold discoveries have previously been made.

JORC resource[hhmc]

The JORC-compliant resource at Bagoe comprises an indicated resource of 750,000 tonnes at 3.5 g/t for 90,000 ounces and inferred resources of 5.85 million tonnes at 2.3 g/t for 440,000 ounces.

Exore managing director Justin Tremain said: “The board of Exore believes the proposed transaction with Perseus represents compelling vaRead More – Source

[contf]

[contfnew]

Proactiveinvestors

[contfnewc]

[contfnewc]